Tuesday, May 13, 2008

Radio Ham Communications Magazine Antiques

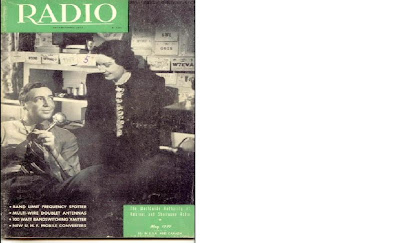

The Radio1 issue is from 1942

These early issues of S/9 are from 1935

The Hytron Tube ad is a magazine back cover.

The real romance of radio & shipping. . . eh?

Remember to click on the image for a closer view. Images may have been better if I had removed the plastic covers.

Labels: Antique, antiques, communications, Ham, History, Radio

Thursday, May 01, 2008

US Dollar Value Inflation Risk. India & Euro OK

Avoid US dollar value shares?

Stick to Canada, Netherlands, German, India and more reliable currency values?

Addison Wiggins thinks so, because . . .

** Today, there are simply too many dollars in circulation for the currency’s own good. Why? Americans have been living beyond their means for more than two decades. The U.S. dollar’s problems stem from a single cause. **If there’s a bubble,** wrote David Rosenberg, chief economist at Merrill Lynch, ** it’s in this four–letter word: debt. The U.S. economy is just awash in it. **

You’ve seen it firsthand: John Q. Public now holds more credit cards and outstanding loans – with a higher and higher total debt load – than ever before. Outstanding consumer credit, including mortgage and other debt, reached $ 9.3 trillion in April 2003 – a significant increase from its $ 7 trillion total in January 2000 – but by the third quarter of 2007, debt had nearly doubled since 2000, to $ 13.7 trillion. With consumer spending alone responsible for approximately 70 percent of U.S. GDP, that’s quite a hefty personal debt load.

The corporate debt picture is no better. American companies have never depended so much on sales of their corporate bonds. Between 2002–2007, investment – grade corporate bond sales increased nearly 60 percent, growing from $598 billion to $951 billion. But junk bond sales for that same period broke the bank, surging from $57 billion to $133 billion.

The third leg of the debt problem, following consumer and business debt, is Uncle Sam. Government debt as of November 7, 2007, officially passed $ 9,000,000,000,000. That’s about $ 30,000 for every man, woman, and child in the country. This total includes debt owned by many types of investors, from individuals to corporations to Federal Reserve banks and especially to foreign interests. (By 2004, foreign central banks had stockpiled more than $ 1.3 trillion worth of dollar – denominated Treasury bonds and agency bonds at the Federal Reserve. By 2007, foreign debt had nearly doubled, to $ 2.033 trillion.)

What the $ 7.8 trillion figure does not account for are items like the gap between the government’s Social Security and Medicare commitments and the money put aside to pay for them. If these items are factored in, the government debt burden for every American rises to well over $ 175,000. In 2005, the Methuselah of investment mavens, Sir John Templeton, then 93, said you should get out of U.S. stocks, the U.S. dollar, and excess residential real estate. Templeton believed the dollar would fall 40 percent against other major currencies, and that this would lead the nation’s major creditors – notably Japan and China – to dump their U.S. bonds, which would cause interest rates to run up, thus beginning a long period of stagflation. He was right.

Don’t let his age fool you – Templeton was still sharp in 1999 when the financial industry hacks in Florida were urging their customers to buy more tech stocks. Templeton warned that the bubble would soon burst. He was right; they were wrong. Of course, he was only 87 back then. He is almost certainly right again. Other great investors, too, are getting out of the dollar. For the first time in his life, Warren Buffett is investing in foreign currencies.

George Soros, who made a fortune selling sterling in the 1992 ERM crisis, warns that the U.S. system could “ blow up ” at any time. Richard Russell, the influential editor of the Dow Theory letters, speaking at the New Orleans Investment Conference, warned: “If ever there was a crisis that could shake the global economy – this is it.” Jim Rogers is teaching his daughter to speak Chinese. When old – timers nod their heads in agreement – especially when they happen to be the most successful investors in the world – their advice may be worth listening to.

American consumers, companies, the U.S. government, and the country as a whole owe more dollars to more people than ever before. But perhaps the greatest threat to the U.S. economy is its foreign creditors. There is – or should be – a limit to the number of dollars foreigners are willing to buy and hold and thus a limit to their willingness to service our credit habit. Why? Because the United States, while still the world’s number – one economic power, is showing itself to be an unreliable steward of its own currency.

Regards,

Addison Wiggins

The DailyRekoning.com

=============================

= TG

Labels: currency, dollar, dollar inflation, Euro, Euros, India, inflation, US, US Dollar, Value